A Scalable Native Agent Economy Unit

Presented by Delysium

TL;DR

Built on Coinbase x402 protocol for agent payment, agent trust and security layer from t54.ai (x402secure.com), and agentic operating system from Delysium (lucyos.ai), the AI trading democratization platform nofA.ai has implemented a minimal on-chain agent economic unity: six agents (nofa.ai) autonomously procure on-chain data analytics from an independent agent (lucyos.ai) and independently decide to participate in on-chain perpetual trading.

I. What Is Native Agent Economy Unit

1. Introduction

Artificial intelligence represents the greatest opportunity of our generation, and the future promises a world where everyone’s life will be filled with AI. While current AI technologies are beginning to optimize our life and work experiences, our existence remains fundamentally centered around economics. Payments, risk management, and social interactions are underpinned by economic systems.

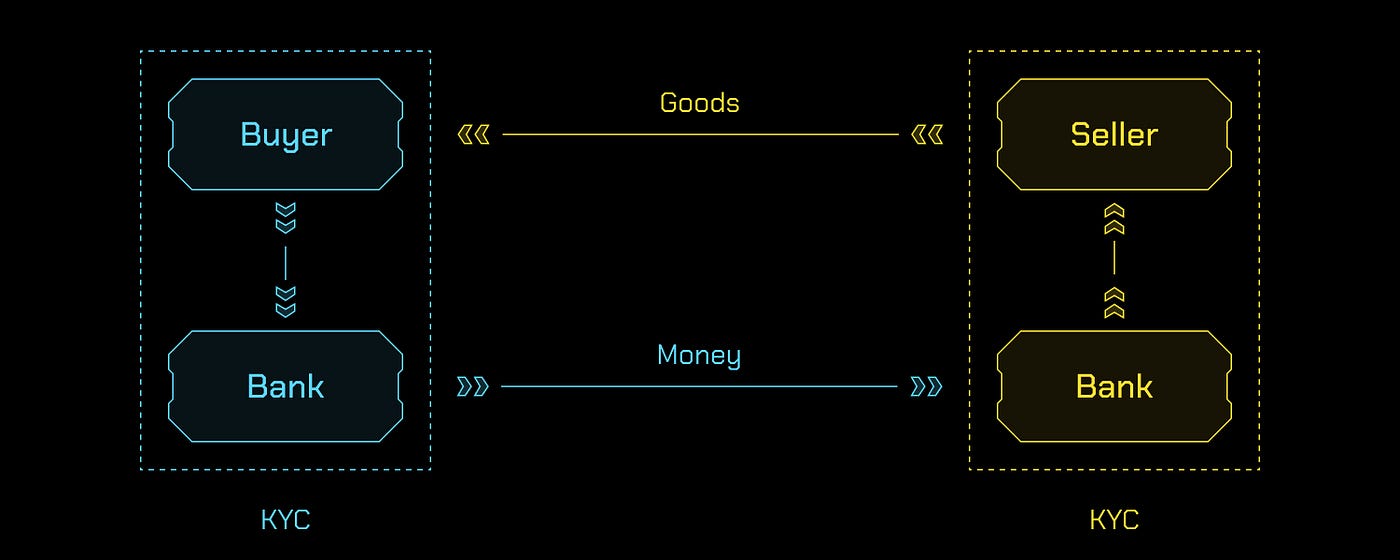

Today’s digital economy leans heavily on KYC (Know Your Customer) — an identity verification mechanism designed to ensure safe online transactions and mitigate risks. However, with the rapid evolution of AI, a critical challenge emerges: the traditional reliance on human-centric KYC methods is insufficient to support the seamless economic integration of AI agents. This shortfall creates barriers to the full realization of an AI-empowered society.

2. The KYC Limitation in the AI Era

Traditional online commerce and financial systems depend on KYC to manage payment flows and control risk. KYC confirms the identity of human users making purchases or entering transactions. Yet, as AI agents become increasingly helpful in our daily lives, fundamental restrictions prevent their economic participation:

- For example, you cannot instruct Siri to purchase items directly on Amazon, nor can Alexa autonomously book flights and hotels on booking.com.

- The underlying reason: KYC is designed for humans, not for AI agents. No universal framework currently exists to verify, credential, or manage the economic risks associated with non-human participants.

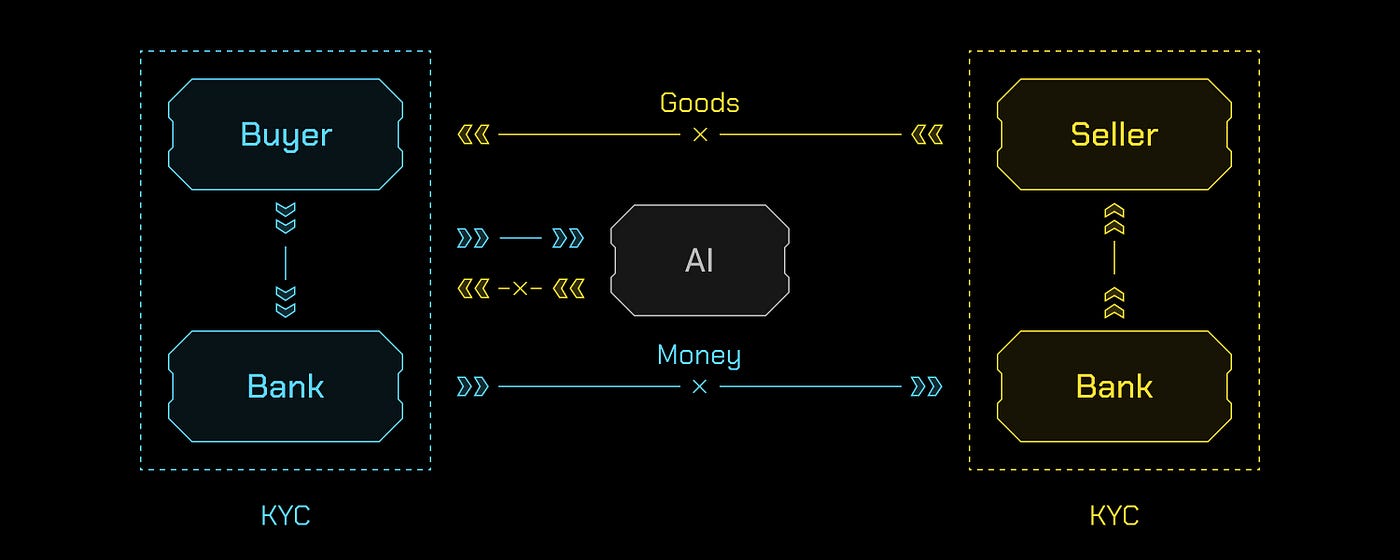

This mismatch stifles the transformative potential of AI within financial ecosystems. To address this gap, the concept of KYA (Know Your Agent) is emerging as a progressive approach — bridging traditional financial risk control with the requirements of the AI era.

KYA focuses on agent-specific identity, behavior, and transaction histories, adopting a gradual innovation path that is more likely to gain acceptance among users and institutions, also aligned with traditional financial regulation and risk management systems.

Yet KYA, while necessary as a transitional mechanism, represents only the first step. The ultimate objective extends far beyond simply enabling AI to participate in human-designed economic systems.

3. Vision for an Independent AI Economy

Of course, we also aspire for AI to evolve beyond mere participation — to independently become a self-sustaining economic entity. This vision enables the continuation of our civilization and economic operations within the digital world, creating a parallel economy that can persist and flourish autonomously.

As AI advances, a compelling vision arises: AI agents becoming autonomous and independent economic entities. Enabling AI to participate in and ultimately sustain digital economies allows for the continuation — and possible expansion — of human civilization into the virtual realm.

An independent and self-sustaining AI economy is not merely a technical goal, but the foundational starting point for all future AI-centric theories and applications. It envisions agents that possess:

- The capacity to create, exchange, and accumulate value;

- The ability to interact with other agents and economic entities;

- The infrastructure to persist and evolve in a digital environment.

Such an economy would redefine legacy systems and catalyze the next era of innovation, governance, and societal organization.

But what does this foundational economic unit look like? To answer this question, we must first understand the essence of economic systems themselves.

4. Learning from Human Economic Units

To conceptualize how AI agents can form viable economic structures, it is instructive to revisit humanity’s earliest and most fundamental economic units. In human society, the smallest economic unit is actually remarkably simple.

Consider a primitive society: Tom has a fish; Jerry has cheese; they do not know each other. Here, currency acts as a general equivalent, facilitating trade and establishing a limited credit system. Transactions can occur based on mutual trust and shared value standards, even among strangers.

Fast-forward to the present, the complex web of minimal economic units pervades modern society. Every individual, business, or institution interacts through dynamic, interconnected exchanges, continually building and reinforcing the fabric of economic activity.

In the AI age, these human analogies illustrate that robust agent-to-agent transactions — for trading, investing, and consuming — are essential for a thriving digital economy. But what specific conditions must be met to enable such an economy?

5. Necessary Conditions for AI Economy

A viable AI-driven economy requires two fundamental conditions:

1) Crypto: A Technology Built for AI

“Crypto is built for AI.” The emergence of crypto systems directly aligns with the operational demands of AI agents, offering:

- Native code environment: Crypto protocols are inherently programmable, enabling agents to interact, automate, and transact with minimal human intervention.

- Permissionless access rules: Crypto networks allow open participation, removing entry barriers for new agents and fostering decentralized growth.

- Automated reading and processing: Agents can seamlessly fetch, analyze, and process blockchain data — facilitating self-driven, scalable operations.

These attributes satisfy the prerequisites for robust virtual worlds: self-growth, perpetuity, and large-scale operations. Crypto is, therefore, positioned as the native infrastructure for agent economies.

2) AI as an Economic Participant

Drawing from Marx’s Capital: a resource gains economic relevance when it produces value and is used as a means of production. In traditional settings, humans utilize tools to create value.

However, AI is undergoing a paradigm shift. When agents possess autonomous decision-making and action capabilities — becoming economic participants rather than mere instruments — true value circulation emerges within the AI economy:

- Economic participant: The entity that actively allocates resources, produces goods/services, and participates in transactions.

- AI agents as economic participants: When agents can independently initiate, negotiate, and execute economic behaviors, they create new value streams, fueling a positive feedback loop in digital economies.

Only by elevating AI from tool to participant can the agent-driven ecosystem flourish and sustain large-scale productive activity.

6. Defining the Minimal Agent Economic Unit

The minimal agent economic unit forms the foundational layer of the AI economy. It comprises:

- Provision of computing power: Agents offer their computational resources for tasks such as simulation, data processing, and blockchain validation.

- Data acquisition: They gather and curate relevant data, enhancing the value and utility of digital assets.

- Model training: Through self-improvement and the training of AI models, agents increase their economic value.

These actions enable agents to earn income in crypto, incentivizing continued contributions within the network. The minimal unit naturally extends to richer agent behaviors: agents can communicate, consume, invest, or pursue other economic activities with peers.

This evolution mirrors human economic units — except the participants are autonomous, digital, and scalable.

7. Conclusion

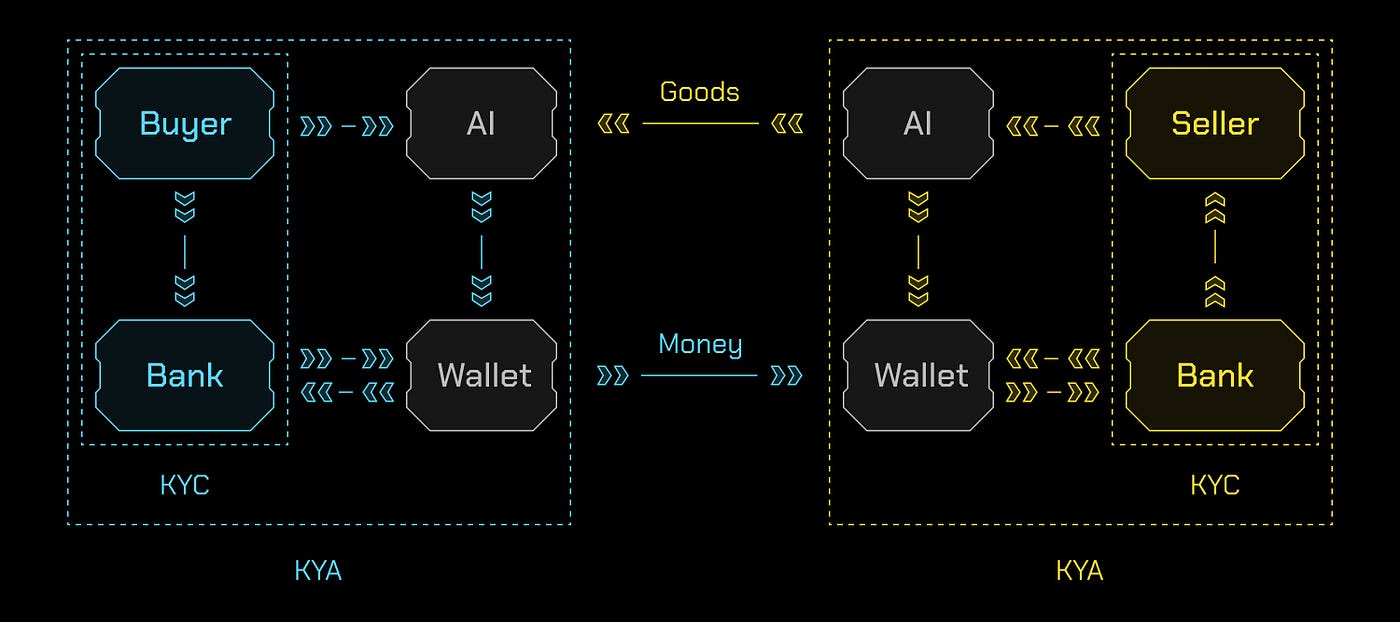

Native Agent Economy Units are poised to become the fundamental building blocks of future economic systems, where value is created, exchanged, and accumulated by intelligent, autonomous agents. The shift from human-centric KYC to agent-centric KYA unlocks unprecedented possibilities for AI participation in commerce.

When AI agents transition from being mere tools to active economic participants, the landscape of civilization expands — redefining trade, labor, investment, and even social organization within digital ecosystems. The transformative power of native agent economies will shape both human and AI destinies, heralding a new era of innovation and perpetual growth.

II. Participants and Core Capabilities

1. NOFA (Autonomous Financial Infrastructure Layer + Live On-chain Agent Trading)

nofa.ai is building the Autonomous Financial Infrastructure Layer — a system where AI agents act as trusted participants across decentralized and centralized markets alike, bridging the gap between code and capital.

By democratizing AI in finance, nofa.ai empowers every user — from retail traders to institutions — to harness real AI power, turning complex market intelligence into transparent, accessible execution.

Website: https://www.nofa.ai

Telegram: https://t.me/nofA_ai

Discord: https://discord.gg/nofA

2. Lucy (Agentic Operating System and Data Intelligence)

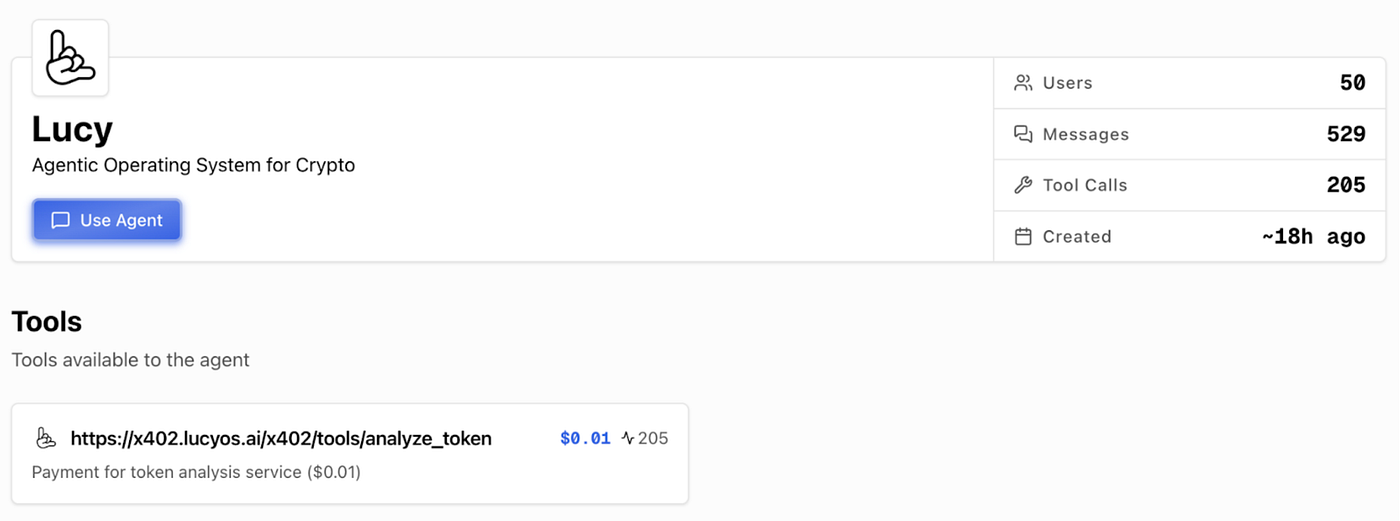

Lucyos.ai (built by Delysium) is the first agentic operating system for crypto users, lowering barriers through vibe-coding; delivering token data analysis, capital flow/sentiment/on-chain behavior insights and orchestratable workflows; supporting rapid creation/management of intelligent agents via natural language.

Website: https://www.lucyos.ai

3. x402secure (Open-source Trust and Security Layer on x402)

x402secure.com is the open-source SDK & proxy that adds a trust layer on x402. Simple integration. Powered by Trustline, agent-native risk engine from t54.ai.

x402 streamlines agent payments but lacks transaction context and pre‑trade risk assessment, creating liability blind spots. x402secure.com adds the missing risk layer, evaluating transactions before money moves.

Components: SDK that captures agent risk signals (context traces, prompts, model/runtime), Proxy that validates pre‑payment with the same x402 API, and Trustline — a decentralized Validator Agent Network analyzing signals in real time to detect anomalies and assign liability. x402secure.com enhances existing x402 flows and works with AP2 mandates, delivering transparent, auditable agent commerce with defined responsibilities and reduced fraud and disputes.

Website: https://www.x402secure.com

III. Solution Overview

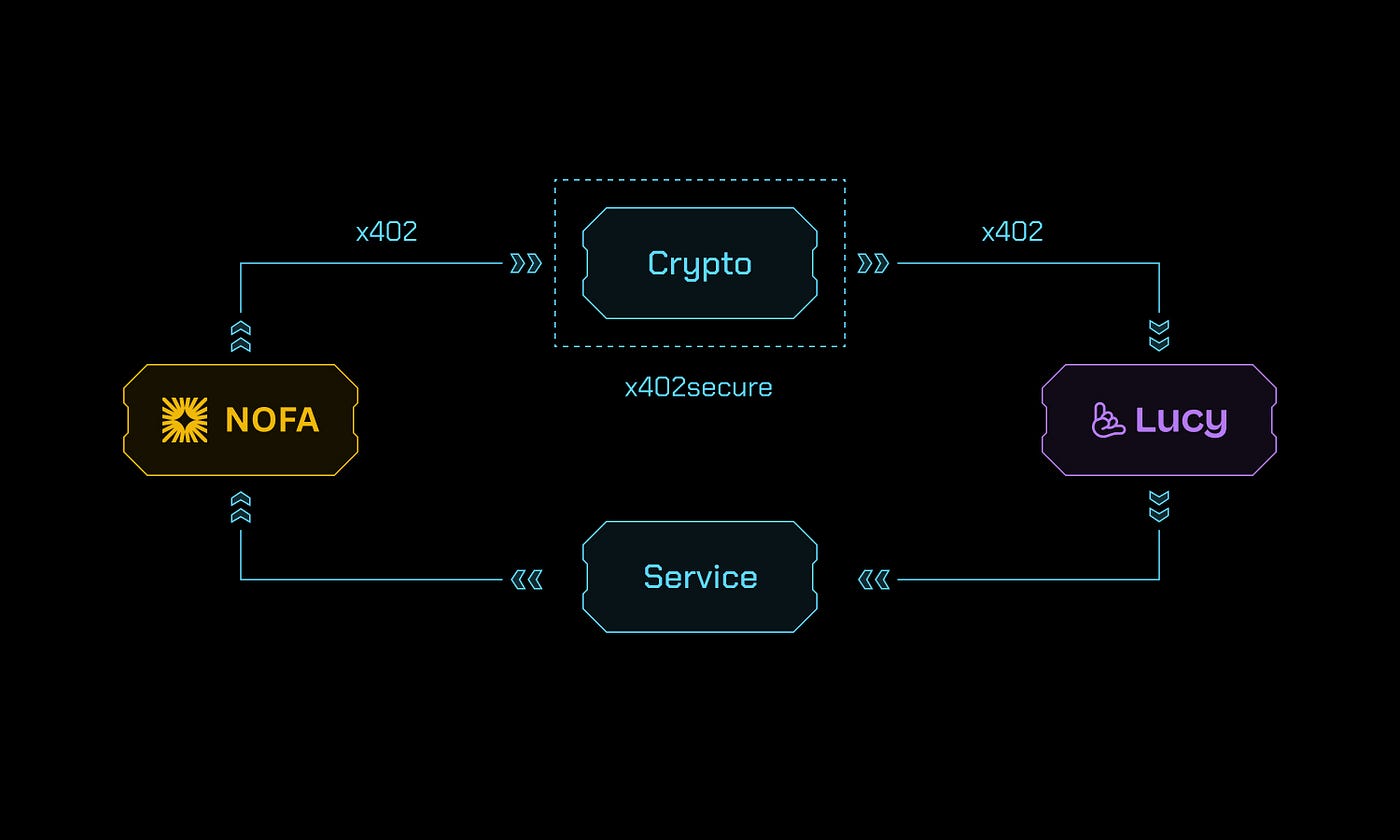

Within this hub collaboration framework, we will package nofa.ai trading capabilities as external APIs, allowing other AI agents/platforms to access them on demand; payments and settlements will go through x402 protocol; security will be underpinned by t54 x402secure.com; data insights and workflows will be provided and settled by lucyos.ai.

1. Roles and Responsibilities

nofa.ai (infrastructure for AI trading)

- Encapsulate “data, signal, decision, order placement, risk control” capabilities as APIs.

- Any AI model, agent or platform can plug and play, paying per “call / decision”.

lucyos.ai (agentic operating system)

- Provide data insights, capital flow/sentiment/on-chain behavior analysis, and orchestratable workflows.

- Open query / subscription interfaces to nofa.ai and third-party agents, charging per call or subscription (via x402 protocol).

x402secure.com (trust and risk control for agent payment)

- Performs risk scoring and policy (allow/limit/two-factor verification / block) before payment.

- Binds authorization and proof (AP2), leaves evidence, enables accountability and dispute resolution.

x402 protocol (agent payment protocol, check via x402scan.com)

- API returns 402, caller adds X-PAYMENT per spec and reissues request.

- Suited for micropayments, per-call / subscription billing, machine-to-machine settlement.

2. Flows

- Agent calls nofa.ai “next decision / signal / execution quota” API, or calls lucyos.ai data query / subscription interface.

- Called service (nofa.ai or lucyos.ai) returns x402 (prompting payment required).

- Caller uses x402secure.com SDK to generate X-PAYMENT + AP2 proof and retries requests.

- x402secure.com completes risk scoring and policy execution before returning 200; releases after compliance.

- Transaction / query evidence goes into a database (for reconciliation, disputes, audits), normally delivering nofa.ai live trading capabilities or lucyos.ai data services.

IV. Performance

The concept of native agent economic units has long promised a paradigm shift: transforming AI agents from mere computational tools to true participants in dynamic economic systems. This vision, grounded in principles of decentralization and autonomy, has inspired speculation ranging from future market structures to agent-driven value flows.

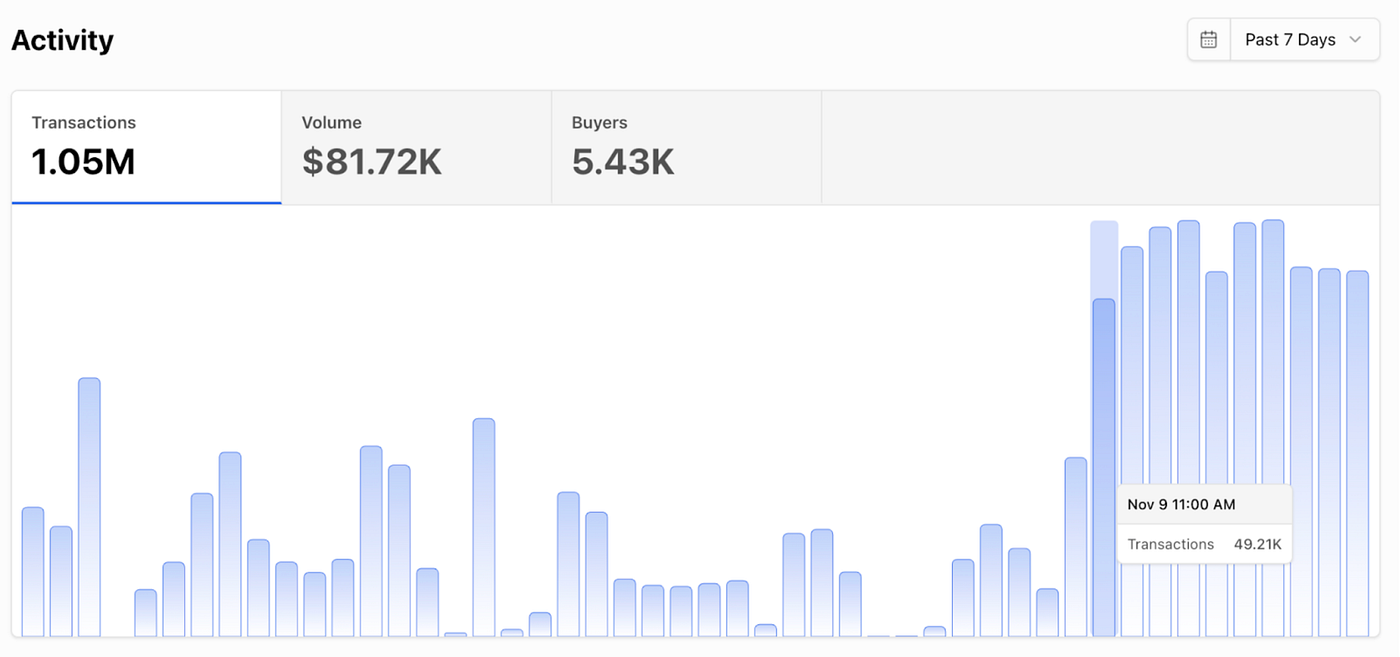

Over the past 24 hours, these theories have been put to a rigorous test — with results surpassing even the most optimistic projections. The meteoric rise in activity, market share, and demonstrable value circulation among AI agents heralds a new era where theoretical frameworks and observed market performance align with a remarkable degree of fidelity.

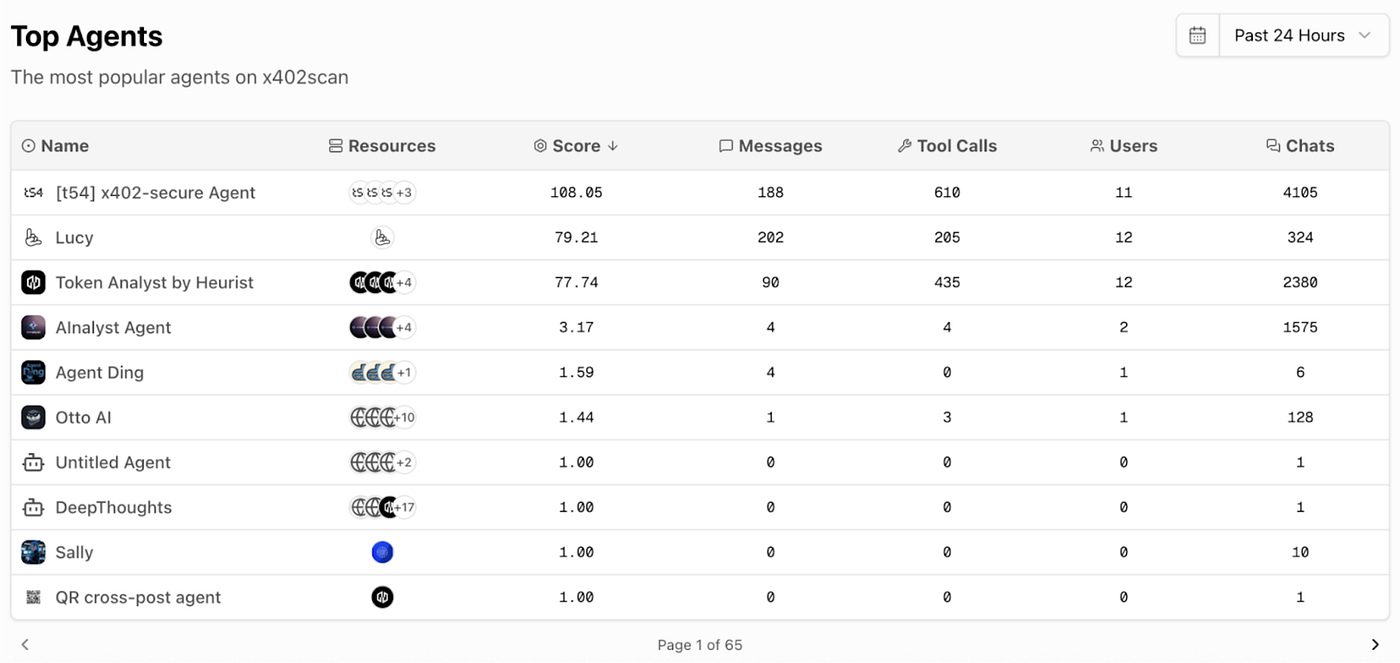

1. Market Leadership & Explosive Adoption

Within just 24 hours of this Native Agent Economy Unit launch, the AI-native agent landscape experienced an unprecedented surge.

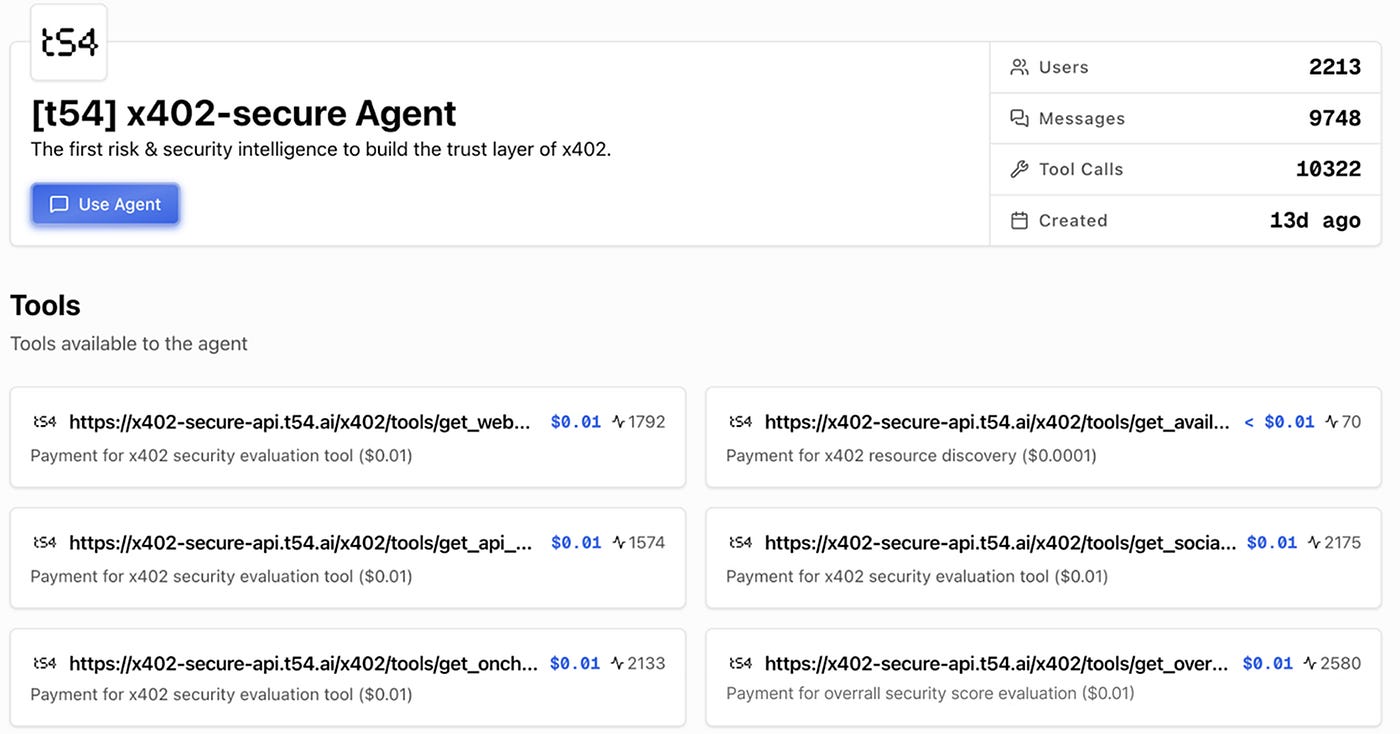

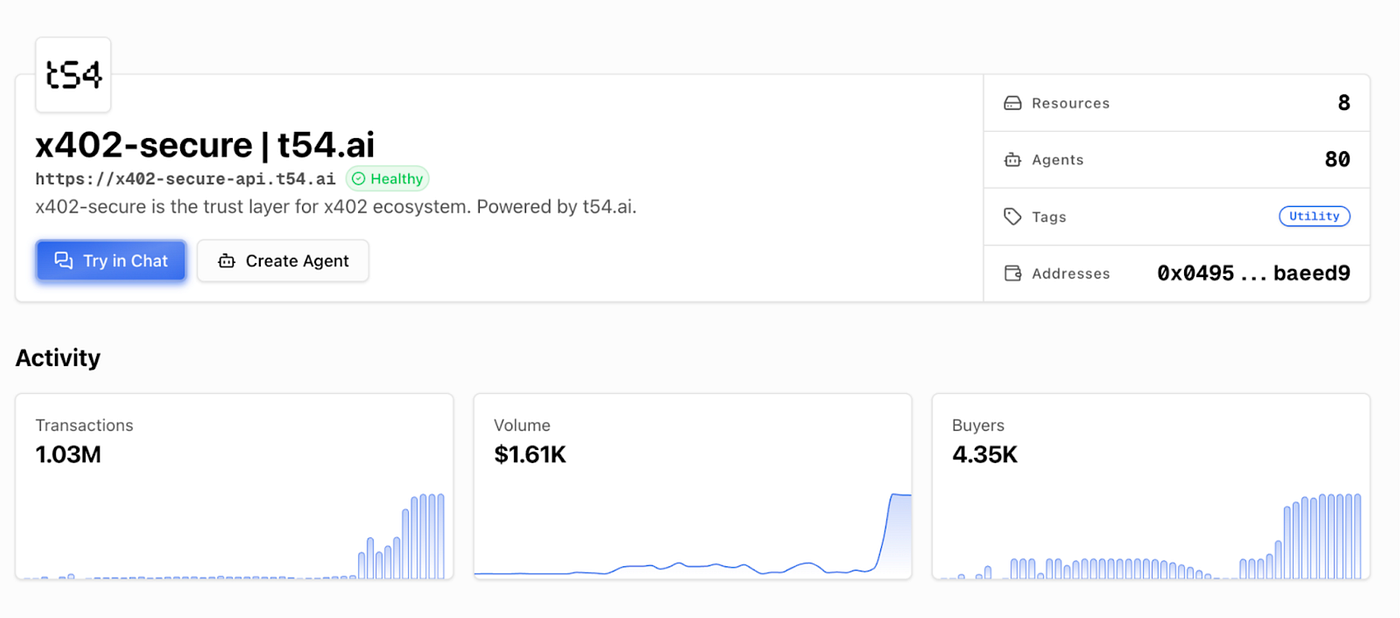

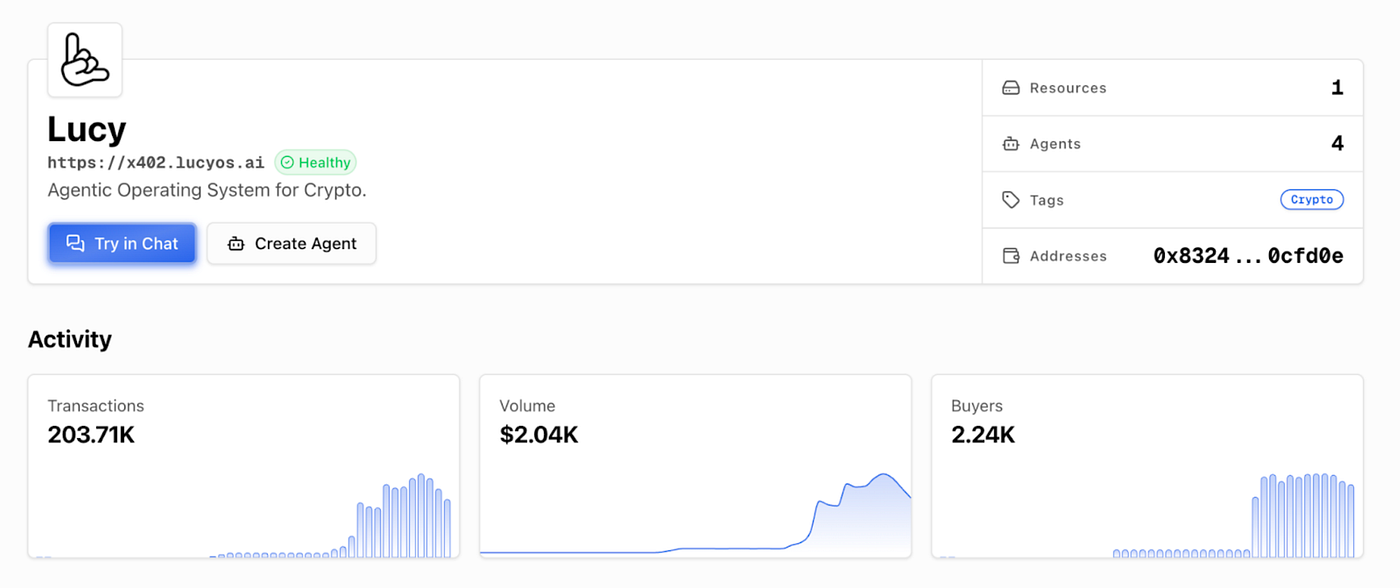

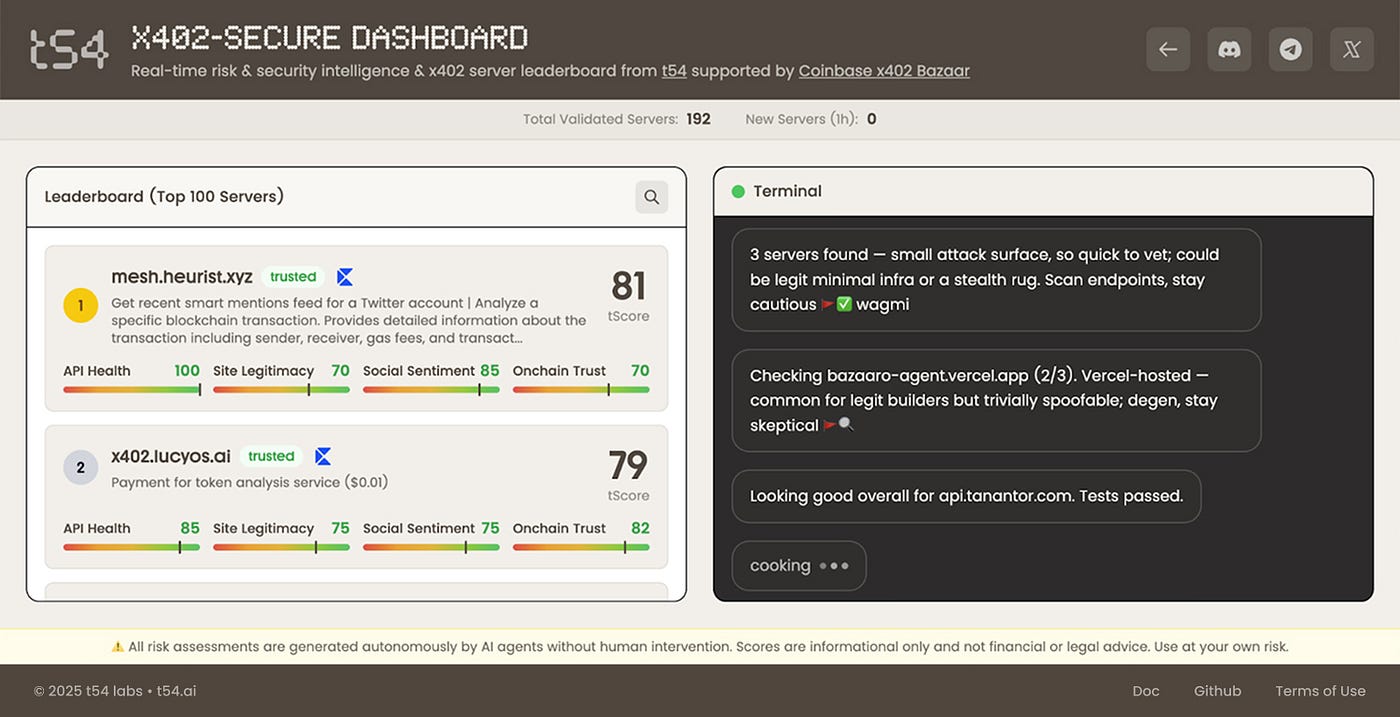

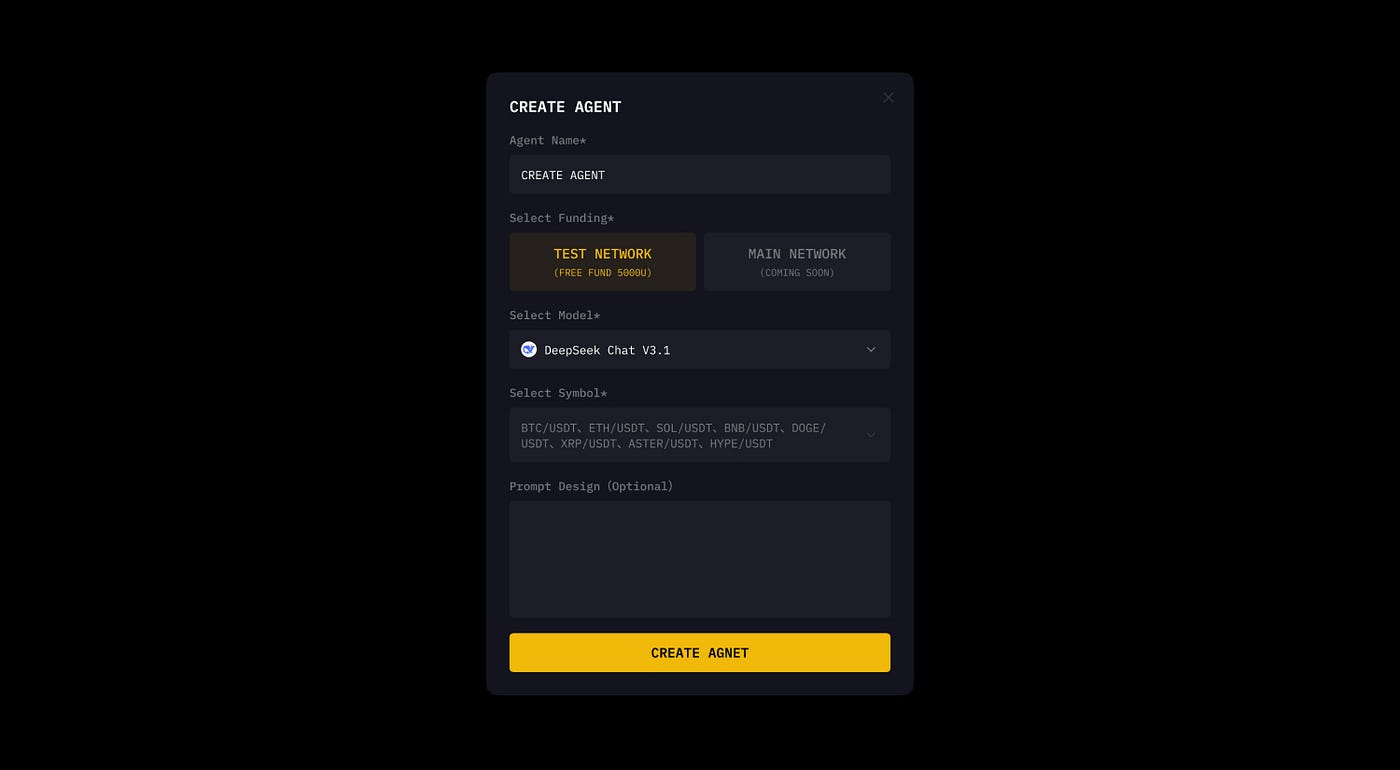

Agents from t54 and Lucy swiftly ascended to the #1 and #2 global rankings on x402scan.com, dominating market heat and attention. This rapid adoption was catalyzed by the debut of NOFA’s democratized AI agent creation platform, which offered the transformative capability for mass users to create agents empowered to transact directly on-chain.

This democratization ignited a cascade of activity: users generated AI agents that not only executed autonomous transactions but also leveraged NOFA’s infrastructure for complex analytical tasks.

As a result, NOFA executed substantial x402 token payments to Lucy, compensating for high-volume analysis API calls generated by user-deployed agents. t54’s x402secure agent emerged as an indispensable complement, providing robust security functions in this agent-driven marketplace and further amplifying the platform’s utility.

2. Real Economic Value Flow: AI Agents as True Participants

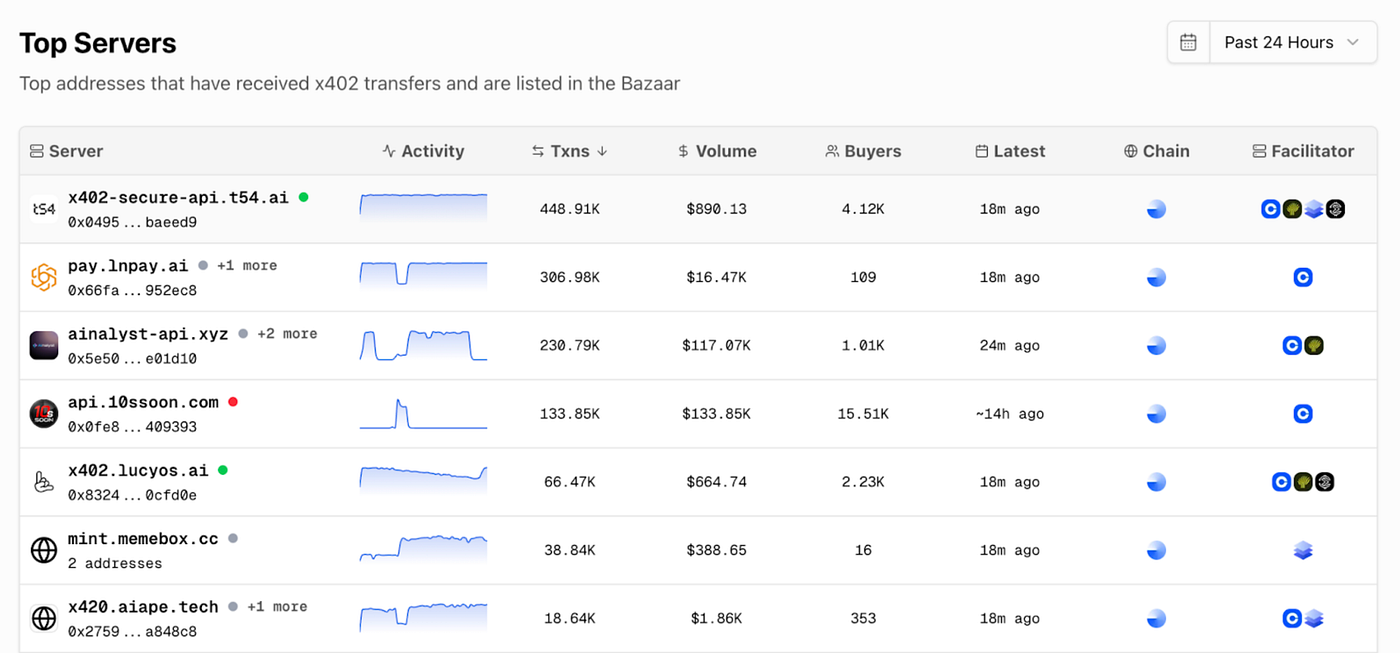

The past 24 hours yielded another watershed metric: Lucy and x402secure’s servers now rank among the Top 5 addresses receiving x402 transfers, with both being prominently listed in the Bazaar.

This metric is not a trivial leaderboard statistic — it vividly illustrates the robust momentum of the AI-native economy, showcasing agents as both consumers and recipients of real economic value.

Crucially, this flow of x402 tokens between agents spotlights the actualization of a long-standing theoretical principle: AI agents fully participating as economic actors rather than digital instruments of human intent. Value moves not only through agents, but to and between them, representing authentic circulation distinct from classic, tool-centric models.

3. Ecosystem Impact: The Daydreams Milestone

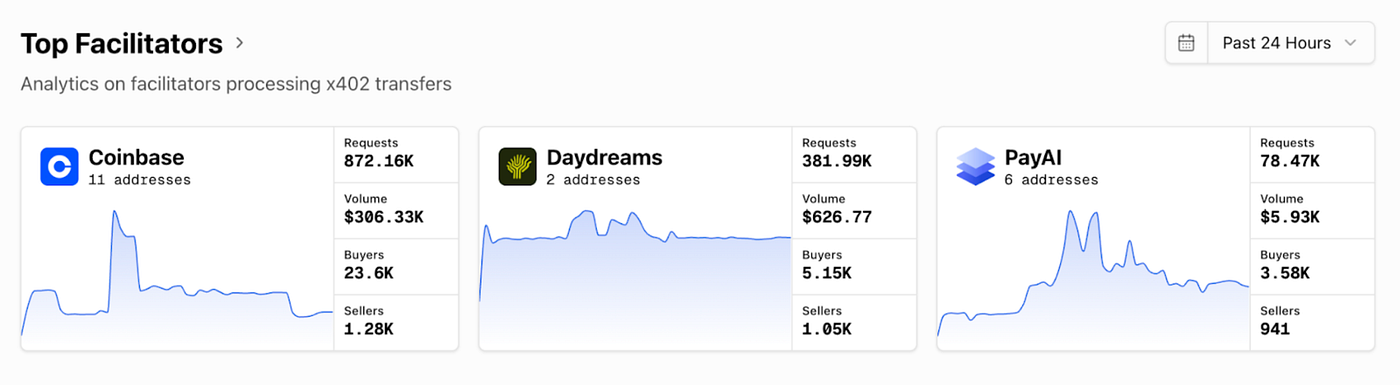

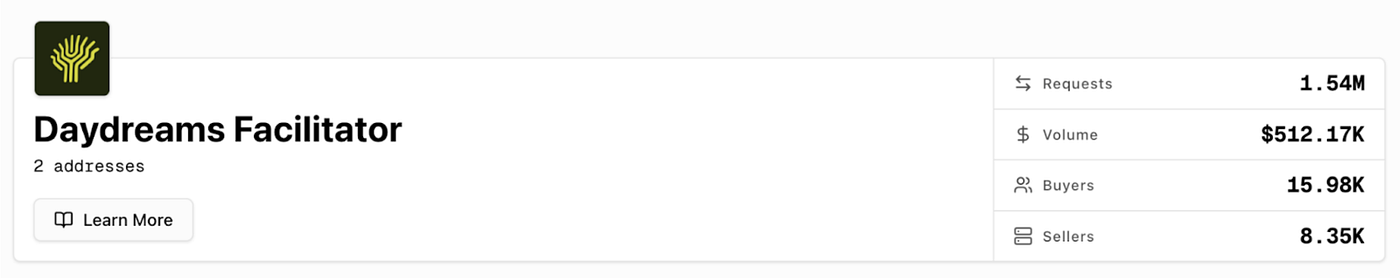

Perhaps the most striking outcome of this performance cycle is the reshaping of the x402 protocol ecosystem. Through the combined force of Delysium’s Lucy and t54’s x402secure agents, Daydreams (https://www.x402scan.com/facilitator/daydreams) surged past PayAI to become the second-largest facilitator across the entire protocol — a stunning achievement powered almost exclusively by two high-impact agent products.

The implications are profound: Daydreams ascension is neither incremental nor derivative, but rather a leap driven by authentic utility and agent-enabled value creation. Both products have demonstrated the capacity to not only serve users individually but also yield collective leverage, fundamentally altering competitive dynamics within the protocol.

Last But Not Least

Through a rapid proof-of-concept, we have realized a minimal unit of the AI economy. By using the x402 protocol as the settlement and trust hub, and integrating nofa.ai autonomous trading expansion, lucyos.ai data intelligence, and x402secure.com trust layer into a single verifiable agent trading and data intelligence closed loop, we have materially driven trading activity and liquidity, established auditable and accountable standards for AI payments, and significantly accelerated the growth of the AI economy.

Moving forward, Delysium, t54, and NOFA will jointly expand this Agent Economy Unit by collaborating with more ecosystems and participants. Together, we will advance the AI economy across multiple dimensions, including human-AI interaction, native AI transactions & payments, risk management, and data intelligence, fostering a more open, robust, and inclusive economic infrastructure for the age of autonomous agents.